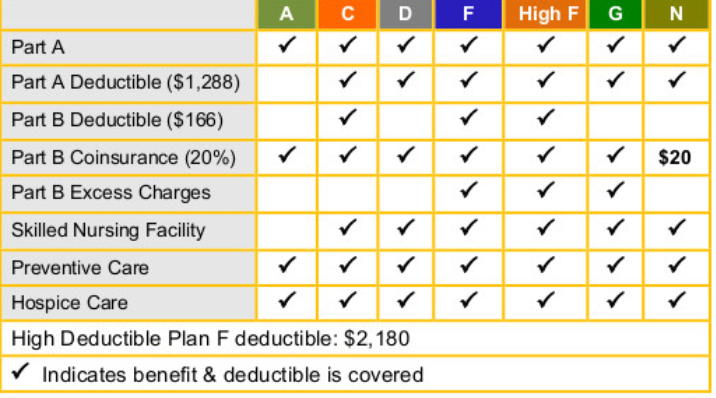

Medicare Supplement Strategies may also be called Medigap approach also it is the insurance policy policy which enables the owners to pay all the co insurance, deductibles, co payments and excessive charges which aren’t insured under their original Medicare program. The plan is designed for everyone that is already enrolled for the Section A Part B Medicare ideas. The Medicare supplement plans 2021 is exceptional and comes with lots of new updates. It covers a lot of the copayments, added fees and also foreign unexpected emergency traveling to get medical treatment beyond the country. Now you might also get your own Medicare Pills by evaluating the different ideas from the Medicare Supplement programs Comparison Chat 2021 which is available on the web.

Guaranteed Acceptance

If you are turning 65 or above the Time of 65, You’re guaranteed Approval in just about any one of those Medicare Supplement Strategies from almost any carrier as long as you arte enroll in some one of the Medicare Strategies after you turn 65. You need to ensure that you have already registered for Part A and Part B Medicare approach just before enrolling to your supplement aims.

What is Not Included in Medicare Program?

The first Medicare Plans don’t insure a variety of healthcare Expenses And to pay those expenses that the Medicare Supplement Plans 2021 are launched. It insures all which are not being coated beneath your original Medicare program. All-the out of these pocket expenses not included in Part A and Part B are insured by the nutritional supplements. This includes:

• Aspect B Deductibles

• Element A Hospital Deductibles

• Co Payments for Healthcare Facility Stays

• Treatment in skilled nursing facility for at Least 20 days

• 20% coinsurance for Health Care Expenses and doctor’s invoices

Each of the standard nutritional supplements cover all these expenses and additionally the Cost of overseas travel for medical treatment beyond the nation.